The success of business heavily depends on the optimum management of resources to run business operations. Along with this, a business has to manage its finances effectively to achieve the goals and objectives of the business. It is a duty of the management to keep a check on the financial resources of the company by using various types of budgets. If you are in your learning stage, this blog post can tell you all about managing financial resources and decisions. Keep on reading to know how resources can be used to its best with zero wastage.

At times students consider the concepts of finance management tough to handle. If you are also struggling with a related topic, you can avail our instant assignment help and resolve your issues.

How does costing matters?

The costing ensures that the cost which is incurred in a particular period should be meet by the profit of that particular period only. The cost of the past year is included in the current period than it will provide the inappropriate result to the management because it creates an inappropriate burden on the particular year.

The organization generally keeps the accounts for the cost as per double entry system to effectively manage the business operation. The costing uses the various cost sheet and the cost statement. It is done for the purpose of ascertaining cost and provides cost control guidelines to the management.

The management also needs to check that the abnormal costs. These costs are not charged to the production unit as the cost has no relation to the production part. It will mislead the management in making various pricing or other decision of the business. The costing helps in ensuring that the abnormal cost is charged to the cost centre and not to any of the production unit. Also, the other expenses which don’t have any relationship to the operation are not charged to the costing. The various business control system used by the manager in the process is the procurement process and business control system.

Procurement process

The process of procurement involves a series of steps. These steps are: finding, acquiring and purchasing resources to manufacture goods and services. To carry out the procurement process one has to gain good analytical skills. This is because it requires consistent analysis and monitoring of the whole activity. As you already read, the manager has to follow a set procedure. It starts from recognizing the needs and involves price, expenditure, sources, invoice and maintenance of records.

Management control system

The management control system gathers the data in order to assess the performance of different units. This tool is widely used to ascertain whether a business is conducting its operations effectively or not. If not, then it would be tough for the business to achieve its goals. Thus, the management control system helps in managing financial resources and decisions to a great extent. It involves a set of activities of decisions which are adopted by managers to establish an aim and achieving it by allocating resources. It is the system which can unite different parts of a company. This further helps in fulfilling the overall purpose of the company because every single unit remains under monitoring which ensures a better performance.

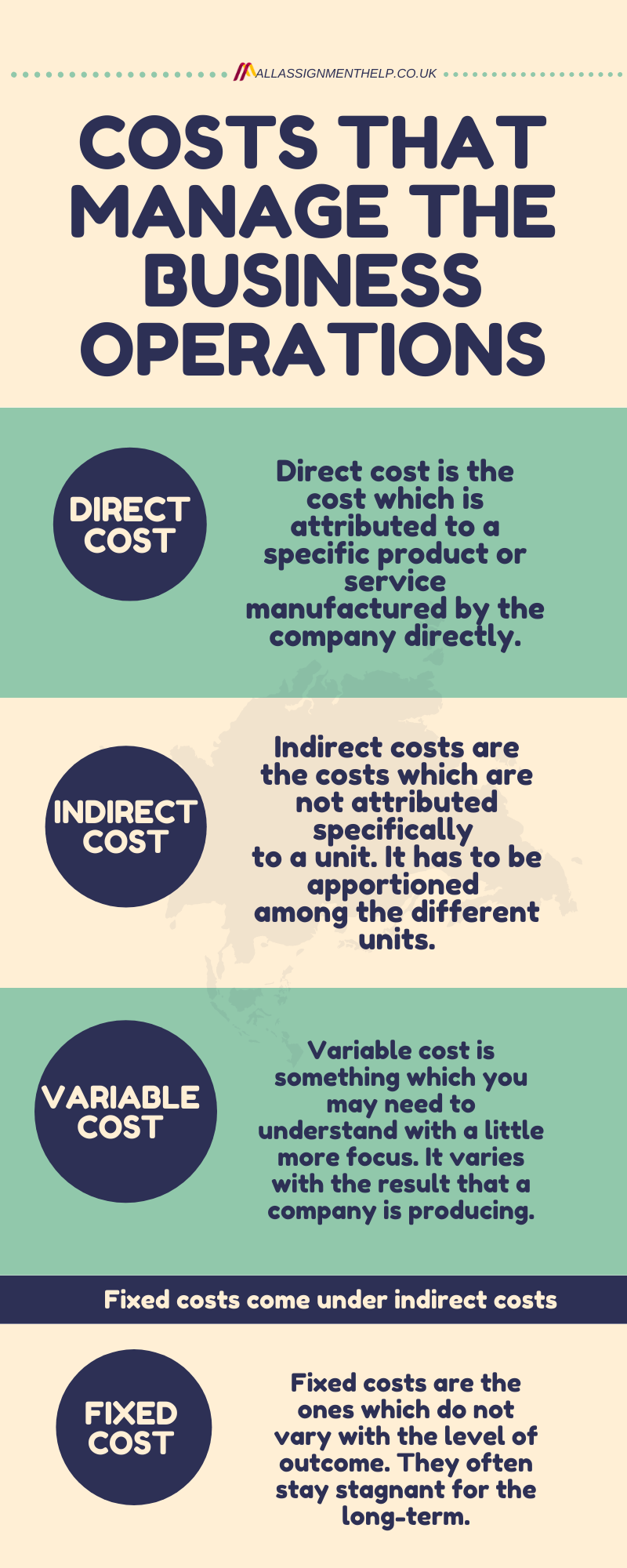

Costs that manage the business operations

When it comes to managing financial resources and decisions to carry out the operations, the management must manage all the costs in an optimum way. There are various types of costs involved in the process of running a business. They all should be managed effectively.

Basically, the cost is any amount which a company pays to acquire or use certain resources for running the business. To manage financial resources and decisions to incur all costs, the management has to carry out in-depth analysis. First of all, the managers have to ascertain cost per unit that the company will have to incur to manufacture its product or service.

At this stage, the role of cost centre comes into action. A cost centre is a unit of business which is related to the production activity. It adds to the cost of running a company. The overall cost which a company incurs on the cost centre is allocated to the units of production. The cost that the resident home has to bear are:

Direct cost

Direct cost is the cost which is attributed to a specific product or service manufactured by the company directly. For instance, the cost a resident home bear on gaining resources to produce food for its members.

Indirect cost

Indirect costs are the costs which are not attributed specifically to a unit. It has to be apportioned among the different units. For instance, the rent of a company premises is not allocated to a specific unit, it has to be apportioned among the different functional units.

To know the major differences between direct and indirect cost, click here:

Variable cost

Variable cost is something which you may need to understand with a little more focus. It varies with the result that a company is producing. For instance, the expense of buying cooking ingredients may differ from the food which is going to be made.

Fixed cost

Fixed costs are the ones which do not vary with the level of outcome. They often stay stagnant for the long-term. They come under indirect costs, hence, rent of a building is also an example of fixed cost too. Other than this, the salaries paid to higher-level employees are also counted under fixed cost. Basically, it is the expense which is not dependent on the levels of goods or services manufactured and sales done. The company or business has to incur its fixed cost irrespective of its activities, profit or loss.

In order to improve profitability and improve its operation, the management should set short term and long term goals. These purposes offer the right direction the business and it can enhance its position. The manager should set up goals for controlling the business and focus on the key areas for improvement. The process of goal-setting helps in using the resources in an effective manner. It also helps in creating a positive environment in the organization.

Regulatory requirements for managing financial resources and decisions

When it comes to managing financial resources and decisions the management should follow a set of regulations set by the regulatory body. It should be done to check whether the resources are being used in an optimum way or not. The regulatory bodies give a guideline to the top-level management which explains the minimum standard. The productivity of the company must not fall below the minimum limit. As per the general guidelines the resident home has to follow rules and maintain its accounting records simultaneously. This process always ensures that the minimum level of consistency remains intact in the financial statements of a company. This further makes it easy for the stakeholders to assess and use the data about the company. Also, it paves a way for clear communication of financial information. Lastly, it aids in driving a comparison with the competitors.

The care quality parties should offer the standard and makes efforts to abide by them. Thereafter, the health and social care should be taken care of too. The management should ensure that all customers or clients are treated with equal respect and dignity. An organization must make sure that appropriate consent is provided. It should be offered before the treatment. As a result of this, no customer or client should be abused by the company’s end neither they should receive ill-treatment while they come for care. Abiding by the rules ultimately ensures that the organization can handle the clients or customer with perfection and handle their complaint in a good way as well.

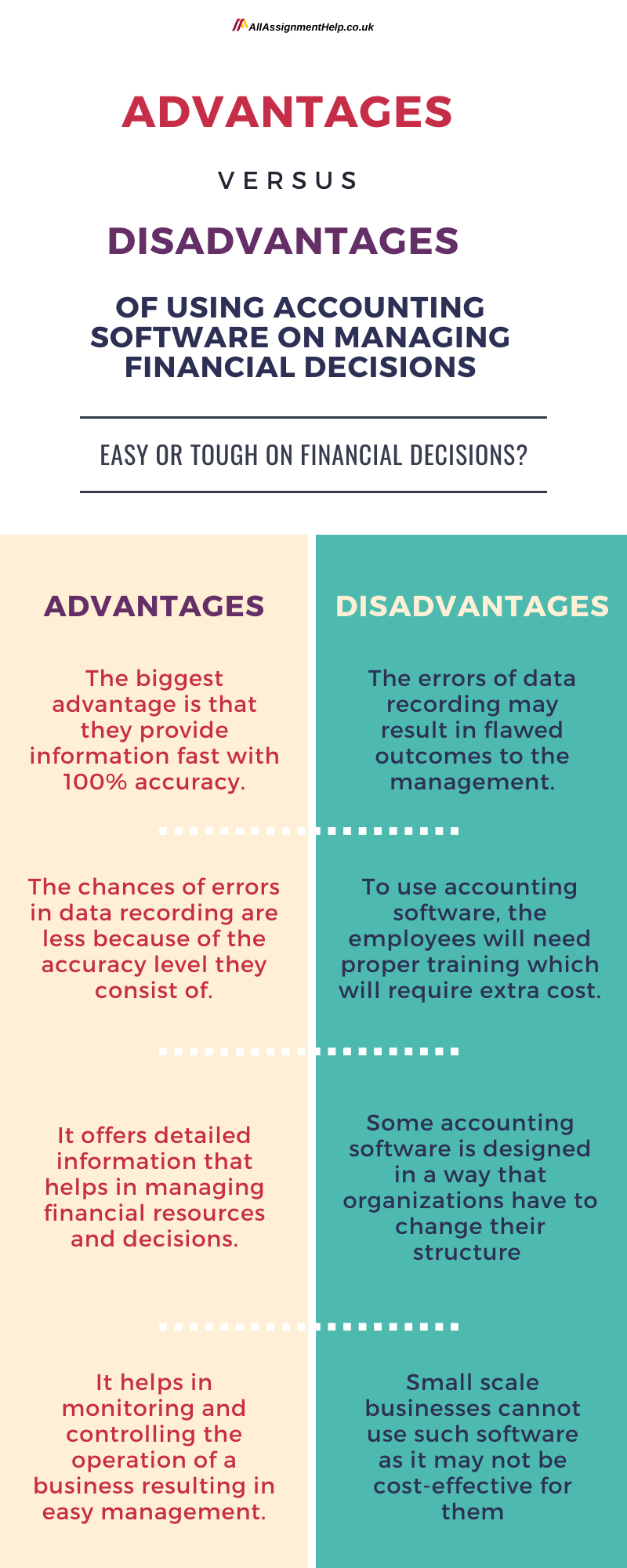

Evaluation of computer software for managing financial resources and decisions

The management of any company uses various software depending on their requirements. Software like database management systems helps in managing the overall income, expenses and assets. The main objective of adopting accounting or finance software is all about managing financial resources and decisions aptly. Furthermore, they help in profit maximization and smooth conduct of business operations. Also, it improves short and long term performance of various units of a business. This is because it gives easy access and clear report on various aspects of the management.

An ideal software ultimately helps the management to check whether the business operations are being conducted in a pre-planned manner or not. Other than this, it helps in setting coordination among various branches of business and minimizes paperwork. It makes record keeping easy too which results in easy maintenance of huge data. Lastly, it facilitates detailed analysis of data which is helpful in managing financial resources and decisions.

The advantage of using accounting software while managing financial resources

- The biggest advantage is that they provide information fast with 100% accuracy.

- The chances of errors in data recording are less because of the accuracy level they consist of.

- It offers detailed information that helps in managing financial resources and decisions.

- They make it easy to store large information and also reduces paperwork.

- It helps in monitoring and controlling the operation of a business resulting in easy management.

- An ideal software can help in reducing the cost incurred by an organization for recording a transaction.

The disadvantage of using accounting software while managing financial resources

- In order to use accounting software, the employees will need proper training which will require extra cost.

- Some accounting software is designed in a manner that organizations have to change their organizational structure to use them.

- The chances of data loss and data theft are higher, which affects the overall functioning adversely.

- The errors of data recording may result in flawed outcomes to the management.

- Small scale businesses cannot use such software as it may not be cost-effective for them.

For a detailed explanation of financial resources and decisions, visit AllAssignmentHelp.co.uk.